AT&T Legacy T General Q & As Part 2

For your information, AT&T put out a calculator to show the total increase in compensation over the course of the agreement minus health care costs. You click on “Legacy T,” your title, where you work, average overtime, and average medical usage and it does the calculation. Note they include the Accelerated Success Share money as part of the compensation package: http://att.benefitscompare.com/

Wages

Q. Is the cost of living computation no longer in the contract?

A. No. We tried to keep it but could not achieve it. However, with the language we had, we did not receive a cost of living increase for the duration of the 2009 agreement.

Q. The Summary document shows an average of 8.21% wage increase although 2.25+2.75+3 =8. Where does the 8.21 come from?

A. The first year it is 2.25% increase over your current wage. The second year’s 2.75% increase is added to the increased wage of the first year’s new wage. The 3% in year three is based on the higher wage created by the last two increases. That ends up being a total cumulative wage increase of 8.21%.

Skills Match

Q. Do employees on Skills Match receive any increase in their severance due to raise increases with new contract?

A. No, termination pay is based on your wages on your surplus date.

Q. Do employees on Skills Match receive the Cash Balance increases if they are still on skills match on 1/1/2013?

A. Yes, since they are still accruing pension benefits.

Q. Employees on Skills Match will be off payroll in 2013 and so will be on new Healthcare Plan and can participate in the premiums Vision/Dental plan?

A. Yes. They will have to enroll during the fall enrollment process – as long as they are still in Skills Match when it goes into effect on 1/1/13.

Healthcare & Pension

Q. If you opt out of Vision/Dental and don't pay premiums, do you still get the same coverage that we had in previous healthcare plan?

A. That is the only plan. We tried to get them to give people a choice, but they refused to run concurrent plans. The bargaining committee felt this was the better option.

Q. Is the HRA money ($1,323) available to use for medical costs incurred from January-December, 2012?

A. Yes.

Q. If you have the Traditional pension plan, do you get the 55/60 year increases in your plan in the event you choose to take cash balance?

A. If someone who is eligible for a Traditional Pension chooses to take their cash balance lump sum instead of their traditional annuity, the additional amounts will be included in their lump payment. Also, the additional money for those over 55 and those over 60 is ONLY for those with at least fifteen (15) years of service. This was left out of the original report.

Q. The $2,400 for the lump sum in Cash Balance also states an added interest credit. How is that calculated?

A. That is based on the 30-year Treasurer Rate, but we negotiated a minimum of 3.75% (which is higher than the Treasury Rate right now). That is added to the account on Jan. 1 of each year.

One-time disability exception letter

Q. If an employee has used up their maximum paid sick days and they have to go out on disability twice, how are they paid for the 5 days preceding the second disability?

A. They are paid once during the life of the contract for days leading to a disability if they've used all their allotted time. If they have two disabilities in the same year and have used the limited exception letter and all their allotted days, they would not be paid for the five days leading to the second disability.

Savings Plan

Q. In the LTSSP will the conversion to the ARSP be automatic or does the employee have to do the conversion?

A. The Company will automatically convert the LTSSP monies to funds under ARSP that are basically equivalent to what the employee has under LTSSP. After that, the employee can make any changes they like including converting the stock to whichever investment funding they chose.

Q. What is a “brokerage account” and how soon after ratification will it be made available to employees?

A. The conversion of LTSSP to ARSP will occur in 2013. Once the conversion is done, the converted funds will be already vested and a brokerage account can be established at any time. You will receive more information on this after ratification and as the conversion approaches.

Accelerated Success Plan Payment

Q. What happens to the $1,323 if the contract is not ratified by 8/17/2012?

A. The normal payout method defined in the 2009 Contract would apply and the payout would be guided by the stock price on Sept. 28. Basically all the changes in the Tentative Agreement would be open for renegotiation. It would not necessarily be a starting point.

LifePath 2024 Bargaining Report: Tentative Agreement

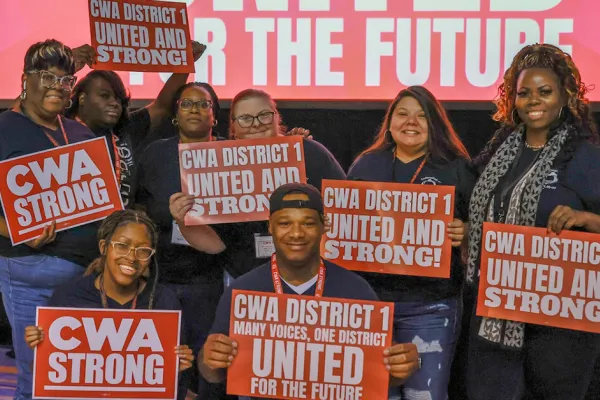

CWA District 1 Holds Annual Leadership Conference

CWA Exposes How AT&T’s Dangerous Gigapower Business Model Undermines Good Jobs and Public Safety in Arizona